SUCCESSION DUTY Meaning and

Definition

-

Succession duty, also known as inheritance tax or estate tax, is a type of taxation imposed by the government on the transfer of assets, money, or properties from a deceased individual to their heirs or beneficiaries. It is a legal obligation that is levied based on the value of the estate or inheritance received by the beneficiary.

Succession duty is typically calculated as a percentage of the total value of the estate or inheritance and is payable by the beneficiary. The purpose of this tax is to generate revenue for the government and distribute the burden of taxation fairly by ensuring that individuals who inherit substantial wealth contribute to the public funds.

The rate of succession duty may vary depending on the jurisdiction, the relationship between the deceased and the beneficiary, and the value of the estate. In some countries, there may be exemptions or reliefs available for certain types of assets or specific thresholds. These exemptions or reliefs aim to protect smaller estates or to provide favorable treatment to certain beneficiaries, such as spouses or charitable organizations.

The collection of succession duty is generally overseen by the tax authorities or revenue agencies of a country, which administer and enforce the tax laws. Failure to comply with the requirements and obligations related to succession duty may result in legal consequences and penalties.

-

In Great Britain, a tax imposed on every succession to property, whether real or personal, according to its value, and the relation of the person who succeeds to the predecessor.

Etymological and pronouncing dictionary of the English language. By Stormonth, James, Phelp, P. H. Published 1874.

Common Misspellings for SUCCESSION DUTY

- auccession duty

- zuccession duty

- xuccession duty

- duccession duty

- euccession duty

- wuccession duty

- syccession duty

- shccession duty

- sjccession duty

- siccession duty

- s8ccession duty

- s7ccession duty

- suxcession duty

- suvcession duty

- sufcession duty

- sudcession duty

- sucxession duty

- sucvession duty

- sucfession duty

- sucdession duty

Etymology of SUCCESSION DUTY

The etymology of the term "succession duty" can be broken down as follows:

1. Succession: The word "succession" comes from the Latin word "successio", which means a following or sequence. It is derived from the verb "succedere", which means to "come after" or "succeed". In this context, succession refers to the act of inheriting or taking over the rights, title, or property of someone who has died.

2. Duty: The word "duty" originates from the Latin word "debere", meaning "to owe". It refers to a moral or legal obligation that one is expected to fulfill.

Therefore, "succession duty" combines these two terms to refer to a tax or duty imposed by the government on the transfer of property or assets from a deceased person to their heirs or beneficiaries. It signifies the obligation or tax liability associated with the succession or inheritance of property.

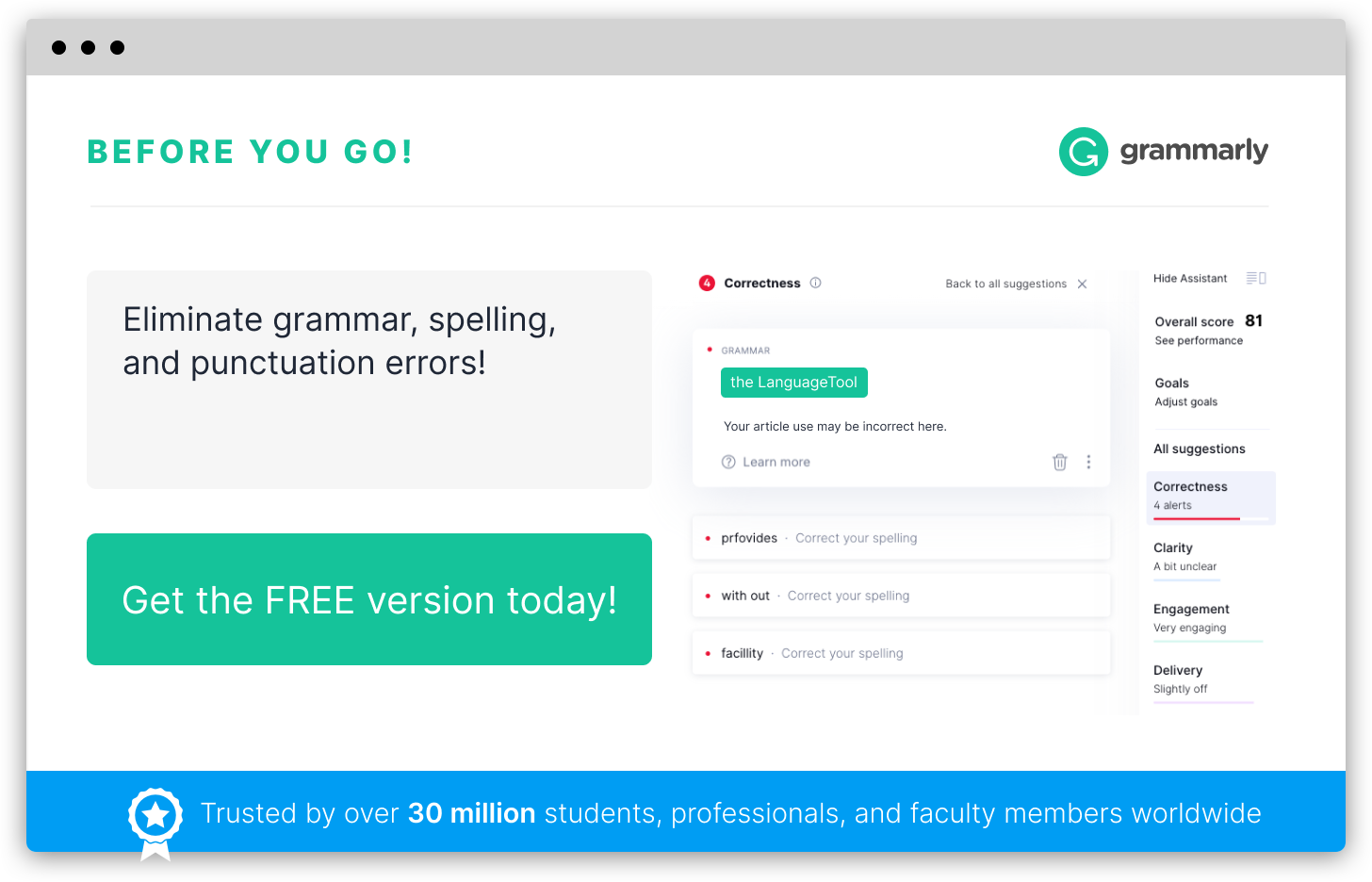

Infographic

Add the infographic to your website: