SELLING SHORT Meaning and

Definition

-

"Selling short" is a financial term used in investment and trading that refers to a strategy where an individual or investor sells an asset, such as stocks, bonds, or commodities, that they do not currently own with the expectation that its price will decline in the future. It involves borrowing the asset from a third party, typically a broker, and selling it in the hope of repurchasing it at a lower price, thus profiting from the difference.

In the context of the stock market, for instance, an investor who wishes to sell short must first locate shares to borrow, and the broker facilitates this process. Once the shares are borrowed and sold at the prevailing market price, the investor hopes that the share price will fall so that they can later buy back the shares at a lower price, return them to the broker, and pocket the difference as profit. This practice is based on the belief that assets experience downward movements just as they do upward movements, presenting opportunities for profit.

Selling short is considered a bearish or pessimistic strategy, as it involves profiting from a decline in an asset's value. It can be seen as a speculative technique, as the investor's gain relies on correctly anticipating and timing the price drop of the borrowed asset. Selling short can serve various purposes, such as hedging against potential losses on other positions, portfolio diversification, or capitalizing on market downturns. However, due to its complexities and potential risks, including unlimited loss potential and margin calls, selling short is typically employed by experienced investors or professionals in the financial industry.

Common Misspellings for SELLING SHORT

- aelling short

- zelling short

- xelling short

- delling short

- eelling short

- welling short

- swlling short

- sslling short

- sdlling short

- srlling short

- s4lling short

- s3lling short

- sekling short

- sepling short

- seoling short

- selking short

- selping short

- seloing short

- sellung short

Etymology of SELLING SHORT

The phrase "selling short" originated from the practice of selling borrowed securities or commodities in the financial markets. The term "short" has its roots in the 17th-century English stock market, where a short seller would sell shares they didn't actually own with the expectation that they would be able to buy them back at a lower price in the future. This practice was called "selling short" due to the fact that the seller committed to delivering the shares in the future, despite not owning them at the time of the sale.

The word "short" in this context likely comes from the longer phrase "to sell the market short of" or "to be short of stock", which were used to describe the act of selling borrowed stock. Over time, the longer phrases were shortened to "selling short", and the term has since become widely used in finance to describe this particular trading strategy.

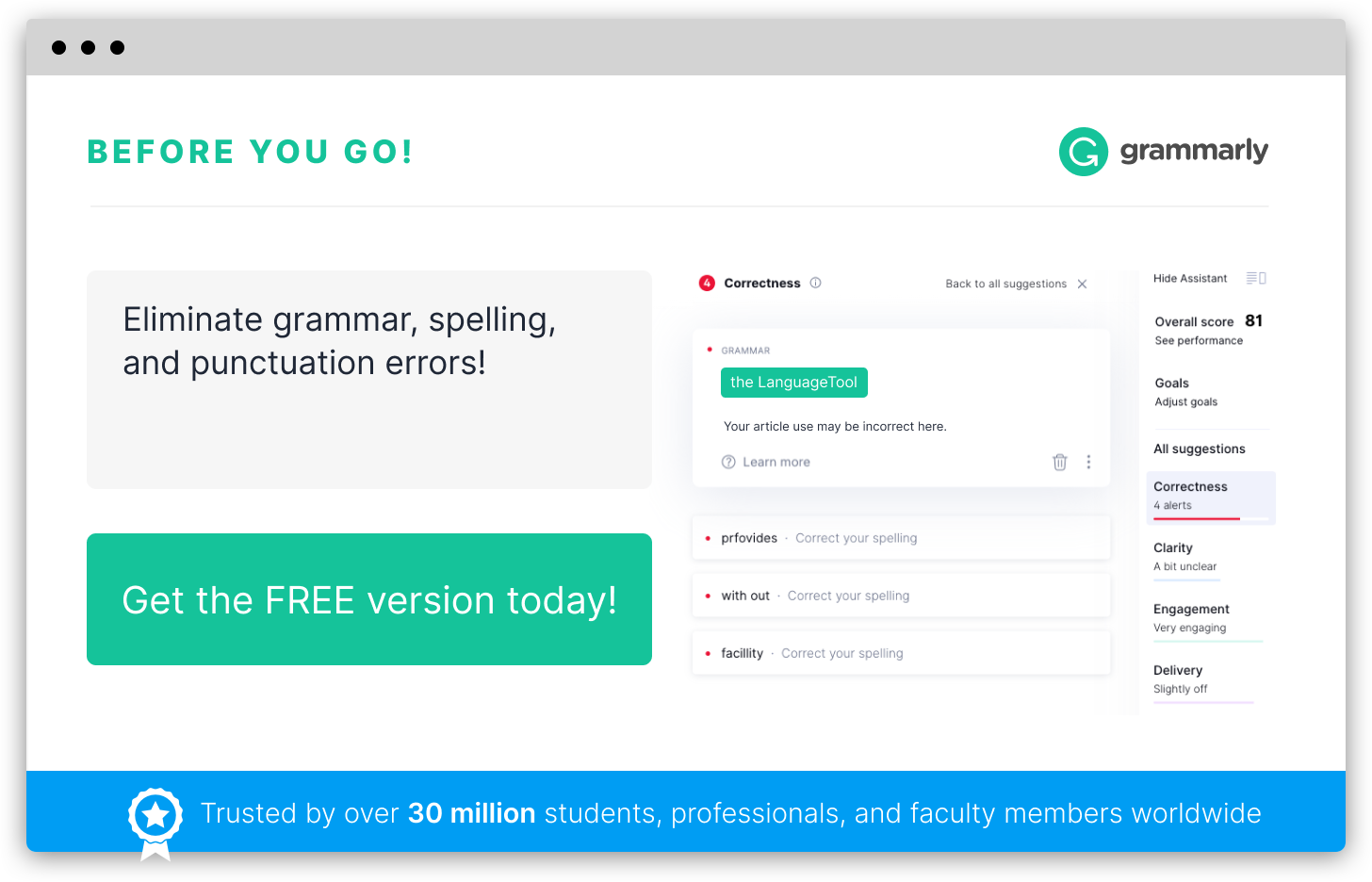

Infographic

Add the infographic to your website: